Most teachers in the United States won't be teachers for their entire career. They might leave the profession altogether, by choice or as the result of a life circumstance, or maybe put their teaching career on pause to pursue other personal or professional goals.

So, if almost every teacher will transition into and out of a pension plan, it makes sense to pay attention to how pension plans treat teachers at those transition points. Every state, with the exception of Alaska, relies on some form of a defined benefit (DB) pension plan, a retirement benefit based on years of service, age at retirement, and final compensation, to determine a teacher’s retirement benefit. Due to the structure of DB plans, they penalize employees for changing states or leaving the teaching profession.

One way retirement plans penalize mobility is through vesting periods. This is true for retirement plans in the public or private sector, but as Chad Aldeman has pointed out, federal law sets limits on vesting periods in private-sector DB plans, and there is no comparable rule for public-sector workers like teachers. States can and do set longer vesting periods than what would be required in the private sector. These long vesting periods makes it hard for new teachers to acquire retirement benefits. If they leave before they are fully vested, they will walk away with only their own contributions, sometimes with interest (keep reading to see why this matters).

Increased vesting periods aren’t the only rules states use to penalize teachers. The National Institute on Retirement Security (NIRS) recently collected state-specific information that illuminates how pension plans enact barriers that penalize teachers at various transition points across their careers. These sorts of barriers can reduce teacher pensions by 50-75 percent, depending on the state and the severity of their penalties.

To illustrate how those barriers affect teachers, consider a hypothetical teacher we'll call "Ms. Mover." In this example, Ms. Mover was born and raised in Florida near the Florida-Georgia border. After 15 years teaching in a Florida public school, she received a teaching opportunity in Georgia that she couldn’t pass up. Knowing she could continue living in Florida while working in Georgia, Ms. Mover accepted the position without regard to her future retirement benefits. We'll use this hypothetical story of Ms. Mover to illustrate four additional ways that state pension plans limit the ability of teachers like Ms. Mover to choose their own professional path:

1. Low Interest Rates on Employee Contributions

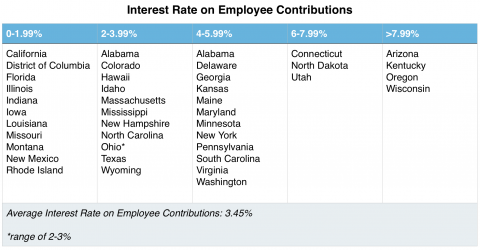

When a teacher chooses to leave prior to full retirement age, she can pull out her own contributions. However, not all states pay interest on those contributions. In some cases, this means that the teachers get back exactly what they put in and states get to keep any interest that accrued on those contributions. The table below groups states based on the interest rate they pay on employee contributions.

The average state pays an interest rate on employee contributions of 3.45%. This is better than the interest on a common savings account today, but it’s about half of what states assume they will earn on their own investments. In many states, teachers are essentially giving the state an interest-free or low-interest loan, because the state turns around and invests those contributions and expects a return of 7.5 or 8 percent. Even if the pension plan hits those 8 percent targets, teachers won’t see a dime of that interest.

For example, as Ms. Mover leaves Florida, she would be eligible to receive her own contributions back but without any interest. (She would qualify for a pension from Florida, but it might be worth less than her own contributions.) She would have been better off putting those contributions into a savings or investment account.

2. High Interest Rates on Service Credits

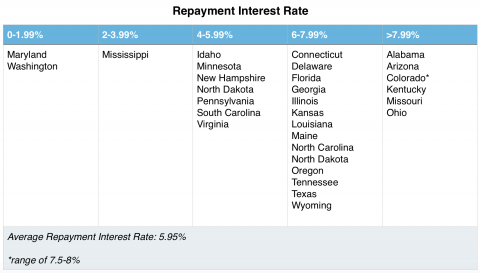

The inverse trend occurs when a teacher attempts to buy back into a plan. If they exit a pension plan but then decide to come back, they must come up with the interest that would have accrued on their contributions had they remained in the pension plan. Of the 31 states that told NIRS what they charge teachers, 19 used a different rate for re-purchases than they paid out to teachers. That means that they’re paying teachers less than what they ask of them if they want to return. If a teacher did want to buy back in, they’d have to somehow come up with the difference between the two sums of money.

Unlike the previous table, “Interest Rate on Employee Contributions,” the states in this chart are clustered closer to the right side. States like Alabama, Arizona, and Colorado, ask teachers to not only make up for any employee contributions, but pay up to 8 percent interest on those contributions.

Ms. Mover, our teacher from Florida, left Florida with only with her own contributions. If she ever tries to go back into the Florida pension system, she would have to come up with all the money she took with her, plus 6.5 percent annual interest.

This discrepancy essentially forces teachers to remain in the pension plan if there’s any question at all about whether they might return, because the risk of having to pay the difference between the two rates is too great. Meanwhile, every year they don’t withdraw their contributions is a year they’re stuck with relatively low investment returns. That makes for a complicated choice, and it’s one reason why so many teachers leave their money in state pension plans even when it might make financial sense to withdraw it.

3. Limits on Purchasing Service Credits

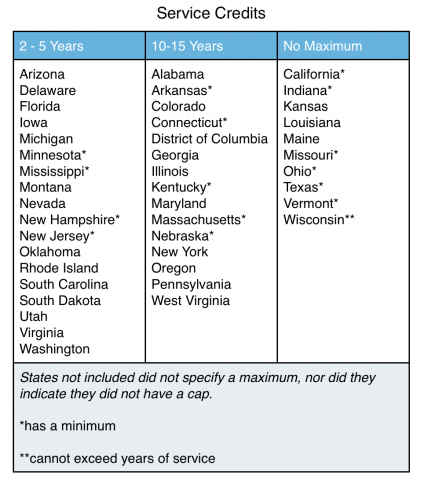

Defined benefit pension formulas rely on years of service, so more years of service means a greater pension benefit for the rest of that teacher’s lifetime. All states offer teachers the ability to purchase additional "service credits," but many place a cap on the number of years of credit an individual can purchase. Those limits are another way that states limit teacher portability.

If we turn our attention back to Ms. Mover, we see how limiting these restrictions can be. Her fifteen years of teaching in Florida don’t travel with her. Instead, Georgia only allows her to purchase a maximum of ten years. Even if Florida gave her a decent interest on her own contributions, and even if Georgia allowed her to purchase credits at a comparable rate, caps like this will limit her future benefits. When she goes to retire at the end of her teaching career, at least five years of service won’t be factored into her retirement at all. The table below groups states based on the maximum number of years available for purchase.

As the table suggests, most states limit how many service credits a teacher can purchase. Only ten states allow teachers to purchase as many service credits as they would like. The most common or modal state restricts teachers to purchasing only five years of service credits.

4. Limits on Types of Qualified Service

Just because a state offers teachers the ability to purchase service credits doesn’t mean it allows them to purchase credit for any purpose. Limiting the types of qualified service (or absence from service) is another way states limit teacher portability.

In fact, 9 states deny teachers the ability to purchase service credits based on years of teaching in another state (they might allow someone to purchase credits for being in the military or serving in the Peace Corps, for example, but not for teaching service). As it turns out, Ms. Mover chose to move to the wrong state. Even though Georgia allows for the purchase of up to ten years of service credit, her 10 years teaching in Florida don’t qualify. Even if there were no transition costs, Georgia wouldn’t allow her to purchase service credit for her any of her time teaching in Florida.

These pension plan rules place constraints on teachers. When making professional decisions, teachers might not see the full picture or how they factor in their retirement. They might not realize the true cost of their movement across sectors or state lines until they reach retirement age.