There’s a common misconception that teachers’ retirement plans are gold-plated, extremely generous options. And for a very small pool, they do provide a secure retirement. But that’s not the case for the majority of teachers. To illustrate this, we dug into a sampling of states to see how they measure up, and ran the numbers to see if an alternative plan design might serve more of their workforce. Here’s what we found for Georgia.

- Georgia’s current defined benefit plan is more extreme than most. The formula used by the Teachers Retirement System of Georgia (TRSGA) offers minimal benefits to short- and medium-term workers and requires an especially lengthy vesting period – ten years. If Georgia teachers stay nine years or less, they do not qualify for any pension or employer-provided retirement benefit at all.

In addition, not all Georgia teachers are covered by Social Security. It’s up to each district to decide whether to extend coverage to educators, and teachers in metro Atlanta, DeKalb, Fulton, and Clayton counties, who do not have Social Security coverage, are particularly vulnerable to a poorly designed state retirement system.

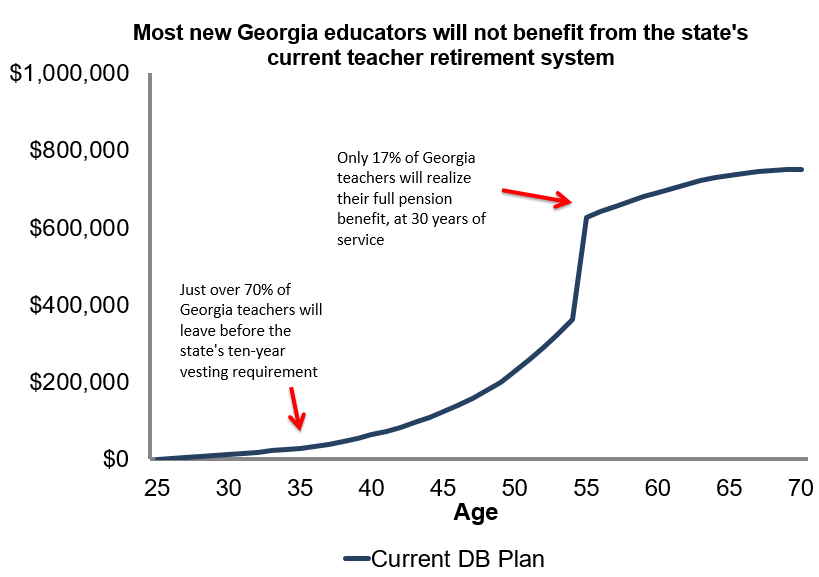

- Most Georgia teachers won’t actually benefit from their retirement benefits. In Georgia, 83 percent of teachers who begin their careers at age 25 will leave before reaching 30 years of service, which is the point when they’ll finally qualify for a benefit that’s more than their own contributions plus interest. The graph below compares pension wealth accrual to Georgia teacher retention rates, and captures this discrepancy.

- Given its current workforce demographics, most Georgia teachers would do better under a more portable retirement plan. A portable plan would better support Georgia’s mobile teacher workforce and allow educators to take their savings with them across state lines or out of the classroom. In addition, nearly all portable plan options would accrue benefits in a smoother fashion, rather than the state’s current back-loaded model. We know most Georgia teachers will leave before they reach peak pension wealth – they shouldn’t suffer from inadequate retirement savings because of it.

All Georgia teachers should have access to a portable, fair retirement plan, as well as Social Security coverage. The current system works for some, but not most of Georgia’s educators. A portable solution could better serve the state’s existing workforce.