In my 401(k) plan, my retirement savings is directly equal to the amount I contribute, the amount my employer contributes, and the amount those contributions grow over time. That's not how teacher retirement plans work. 90 percent of teachers earn retirement savings based on a formula relying on their age, salary, and years of experience. The contributions made into those plans are related but not directly tied to what teachers actually receive in benefits.

This discrepancy is due to debt. My 401(k) plan has no debt, and indeed my employer contributes what they promised each year, nothing more and nothing less. Pension plans, on the other hand, can and do accrue large debts. They promise a certain level of future benefits but often fail to save enough in the present. As debts rise, teachers, school districts, and states must make higher contributions than they otherwise would. They must pay debt costs in addition to the cost of providing benefits.

Pension debt alone now eats up to about 10 percent of the average teacher's compensation. Remember, this is money that is spent on teachers but isn't actually going to them now or in the future; it's money just to pay down debts that were accrued in the past.

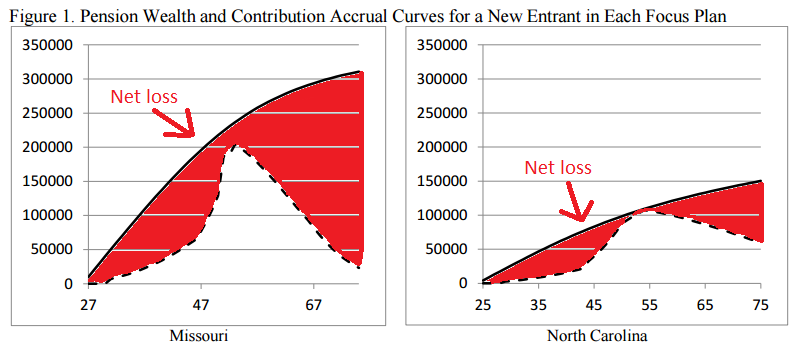

A new CALDER working paper, "Benefit or Burden? On the Intergenerational Inequality of Teacher Pension Plans," helps illustrate this distinction. The graphs below, a modified version of Figure 1 from the paper, shows the total contributions that will be made into the pension plan over a teacher's working career (the solid black line) versus the actual benefit teachers would receive at a given stage of their career (the black dotted line). These graphs are from Missouri and North Carolina, but the paper models similar graphs for Tennessee and Washingon. The authors also show national figures and the percentage of states that suffer from this discrepancy. I've added the red bars to show the gaps between the two lines, representing the net loss teachers face at every stage of their career.

As the graphs illustrate, teachers at all stages of their career face a net loss from their retirement plan. They and their employers are paying more into the pension system than they'll ever get back. The actual losses vary across a teacher's career, but at no point in any of the states the authors studied would the teacher finally surpass what was contributed on her behalf. On average, Missouri teachers are losing about 10 percent of their salaries and North Carolina teachers are losing about 3.5 percent.

It doesn't have to be this way. As the authors note, there are retirement plans, like my 401(k) plan, that never accumulate debt costs. There are other retirement plan designs, such as cash balance plans, that are also unlikely to suffer from these problems. In keeping the existing defined benefit pension plans, policymakers are choosing to preserve a system where teachers and their employers are contributing more than teachers will ever receive back in benefits. This is a bad choice, and it's a big reason why teacher salaries remain low and flat.